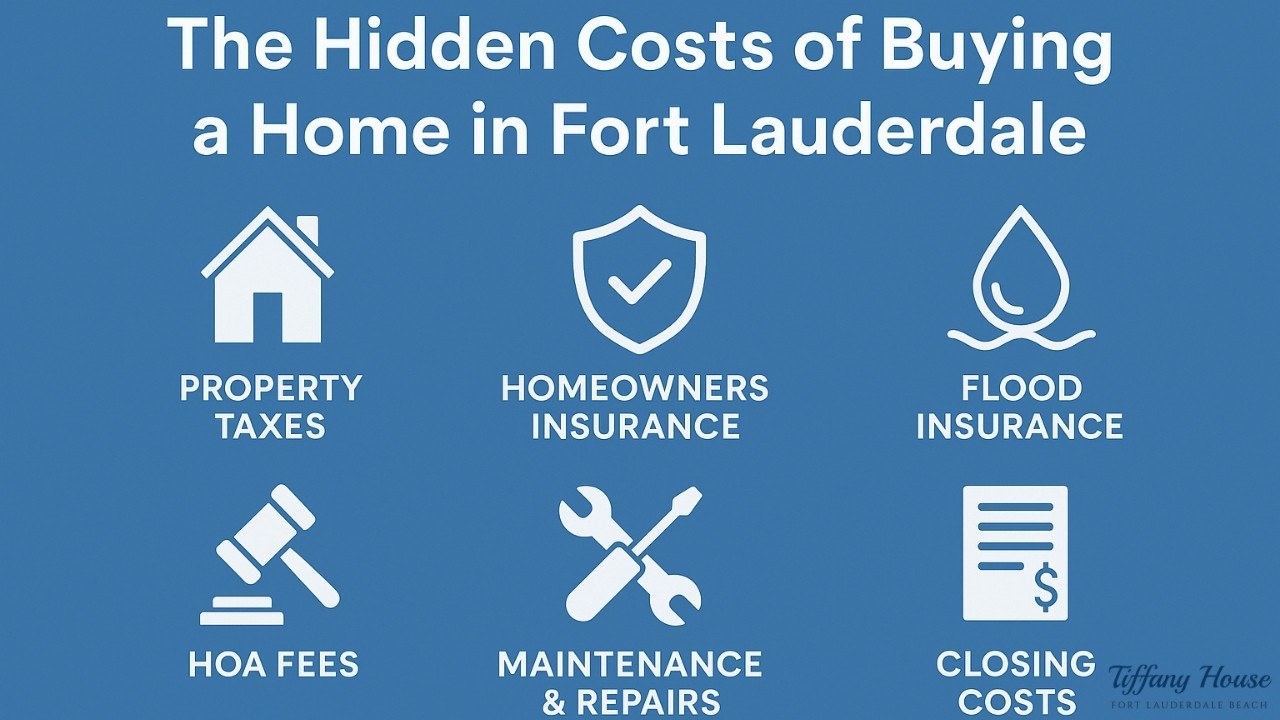

Buying a home in Fort Lauderdale is exciting, with sunny weather, vibrant communities, and the dream of coastal living. But before you close the deal, it’s important to understand that the purchase price is only part of the story.

Many first-time and even seasoned buyers are surprised by the hidden costs of owning property in this area. Knowing them early helps you plan your budget and avoid unpleasant surprises later.

1. Property Taxes

Property taxes in Broward County can take up a noticeable share of your yearly budget. They usually run around 1% of your home’s value each year, though the exact amount depends on your neighborhood and any exemptions you qualify for.

Also, if your home’s assessed value rises, property taxes can increase over time. Always review recent tax records before making an offer.

2. Homeowners Insurance

Because Fort Lauderdale is hurricane-prone, homeowners’ insurance tends to be higher than average. You’ll need coverage for wind, water, and storm damage; depending on where you live, it could cost several thousand dollars a year.

Before you buy, request an insurance quote for that specific home. Premiums can vary widely based on location, age, and construction quality.

3. Flood Insurance

Your lender may require flood insurance if your home is near the coast, canals, or low-lying areas. Even if it’s optional, it’s a smart move for peace of mind.

Costs vary depending on elevation and risk zone, but expect anywhere between a few hundred and over a thousand dollars per year. Always check the property’s flood zone status before you buy.

4. HOA Fees and Special Assessments

Many Fort Lauderdale homes, especially condos and luxury communities, have Homeowners’ Association (HOA) fees. These fees cover shared amenities like pools, security, landscaping, and building maintenance.

HOA dues range from $400 to $700+ per month. But the real surprise comes when a community issues a special assessment, a one-time payment for significant repairs or upgrades. Always review HOA financial statements to see if big projects are planned.

5. Maintenance and Repairs

Homeownership means upkeep, and maintenance is necessary in Florida’s humid climate. Set aside 1–2% of your home’s value each year for ongoing care, like:

- Roof or A/C maintenance

- Pool cleaning

- Landscaping

- Pest control

- Exterior painting and sealing

Luxury homes or older properties may require even more. Regular care keeps your home in great shape and protects its value.

6. Utilities and Everyday Costs

Utility bills in South Florida can be higher than expected, especially during the summer months when A/C runs nonstop. Add in water, sewer, trash pickup, and security systems, and it’s clear that utilities deserve their own budget line.

Also, prepare for storm readiness expenses, like hurricane shutters, generators, and maintenance supplies.

7. Closing Costs

Finally, you’ll pay closing costs and one-time fees during purchase. These include:

- Title search and insurance

- Appraisal and inspection fees

- Loan origination charges

- Legal and document fees

They usually total 2–5% of the purchase price. Review your lender’s closing disclosure carefully before signing.

Live Smart, Live Luxury: Discover Tiffany House, Fort Lauderdale

If you’re ready to experience Fort Lauderdale’s luxury lifestyle without the stress of hidden costs, explore Tiffany House Fort Lauderdale, where style, comfort, and wise investment meet.

Ready to find your dream condo or home?

Contact Tiffany House Fort Lauderdale today for a private showing and discover why it is the preferred choice for luxury living in South Florida.